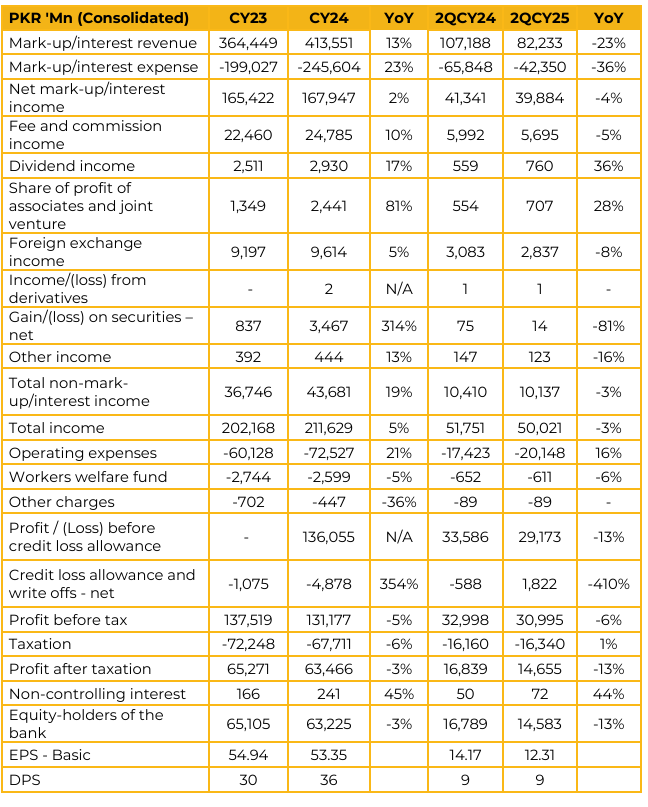

The bank is focusing on optimizing its existing branch network. However, it may open new branches in areas with good business opportunities towards the end of the year. As of June 2025, the bank’s Current account has increased to 54% of total deposits, up from 49% in December 2024. This growth is 27% year-on-year, significantly higher than the industry average of 16% year-to-date.

The higher Current account concentration, coupled with a lower policy rate, has led to a decline in the cost of deposits to 4.86% in June 2025, from 10.05% in June 2024. The yield on advances was 11.12% in June 2025, a decrease from 18.47% in June 2024. The bank’s advances also saw a decline of 37% to Rs658 billion, in contrast to the industry’s 15.5% decline. As a result, MCB’s market share in advances fell to 4.86%.

The cost of borrowing stands at 11.1-11.15%. Profitability remains solid, with a consolidated profit before tax of PKR 62.5 billion. However, fee income, particularly from remittances, saw a 13% drop due to increased competition, even as the bank’s overall home remittance inflows grew by 16.7%. The bank’s Islamic banking division also performed well, posting a profit of over PKR 1 billion with 22% deposit growth Despite recoveries from NIB Bank slowing down, MCB Bank does not anticipate needing to set aside a significant amount of money for loan provisions in the upcoming quarter. In fact, they may even be able to reverse some of their existing provisions.

The management aims to bring the cost-to-income ratio below 40% in upcoming quarters. In June 2025, this ratio was 38.05%, compared to 30.7% in June 2024. The bank recorded a loss of Rs1.2 billion on remittance commissions in the 1HFY, a decline from Rs820 million in the 1HFY24. This loss is attributed to rising competition, and the bank expects it to normalize in the coming quarters. Management anticipates a pause in the interest rate cycle for now. However, a cut of 50 to 100 basis points is possible by the end of 2025.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.