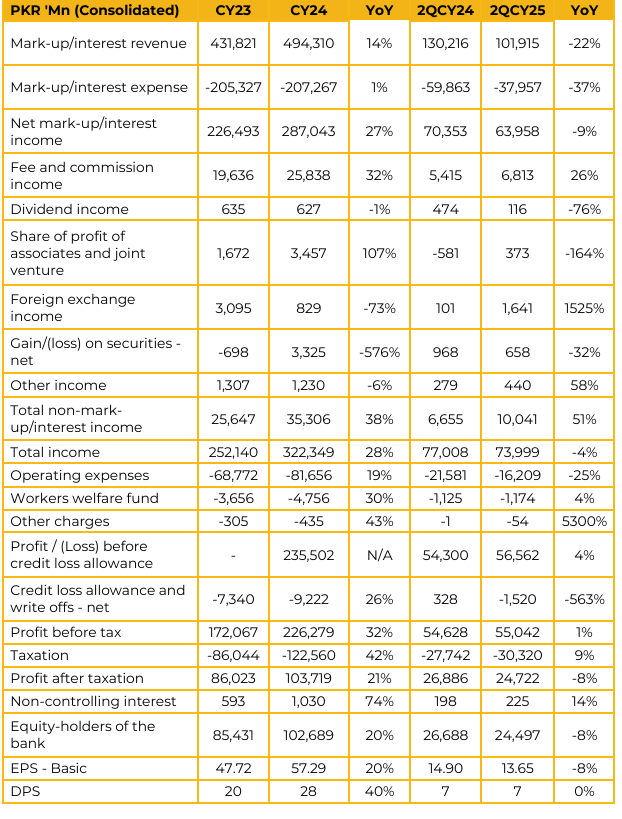

Meezan Bank Limited reported a consolidated profit after tax of PKR 103.7bn in CY24, an increase from the PKR 86bn reported in CY23. However, the company’s profit after tax in 2QCY25 was PKR 24.7bn, a decrease from PKR 26.9bn in 2QCY24. The bank’s total deposits are PKR 3.04 trillion, comprising 51% in current accounts and 43% in savings accounts. Current account deposits have risen by 36% YoY.

The gross advances-to-deposits ratio is 39%. The non-performing loan ratio is 2.5%, primarily concentrated in the construction, steel, and textile sectors. The capital adequacy ratio is 23.6%. The company’s cost-to-income ratio is 25.6% due to a one-off reversal; management anticipates it will normalize to 35-40% in the future. The bank handles 10.2% of the total traded value of imports and exports.

Total investments amount to PKR 2.39 trillion, a 45% YoY increase. The investment portfolio consists of 89% Government of Pakistan (GoP) Ijarah Sukuk, 10% Energy Sukuk, and 1% other investments. The bank’s total assets are PKR 4.13 trillion, representing a 26% YoY growth.

The investment portfolio’s variable sukuk holdings constitute 80% with a yield of 11.5%. The majority of these are expected to reprice in October and November of this year, leading to an average yield decline of 60-70 basis points (bps). The bank has expanded its network to 1,057 branches across Pakistan, adding 6 new branches this year. Management plans to increase the number of branches to nearly 1,100 by year-end. Fee and commission income contributed PKR 10.87 billion to total revenue, a 15% YoY increase. According to management, the demand for private sector credit has not yet picked up, resulting in low loan book growth. Regarding deposit growth, they commented that with the withdrawal of the ADR tax, they expect core current and savings accounts to grow by more than 20% in the foreseeable future.

The bank’s target for its advances-to-deposits ratio is approximately 50%, which they expect to achieve. Going forward, management is likely to continue a similar dividend pattern and focus more on growth, although the final decision rests with the board. They also anticipate that the interest rate will stabilize at 10%, with room for a 50-100 bps interest rate cut.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.