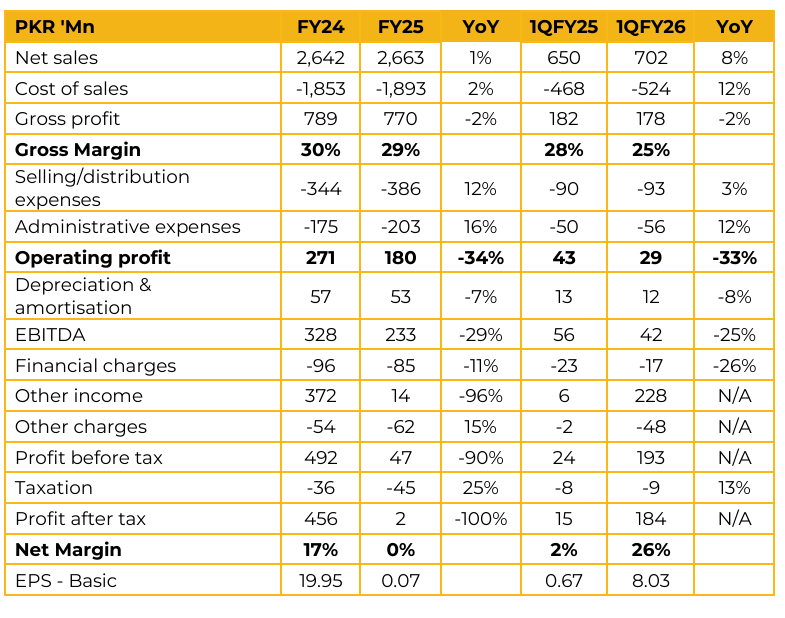

Mitchells Fruit Farms Limited (MFFL) reported earnings per share of PKR 19.95 for FY25, compared to PKR 0.07 in FY24. Furthermore, in 1QFY26, the company reported earnings per share of PKR 8.03, compared to earnings per share of PKR 0.67 in the same period last year (SPLY).

The company has undergone a major transformation following the acquisition of a controlling stake by CCL Holding Private Limited. The acquisition by CCL Holding was completed post close 1QFY26. It operates across 12–13 product categories, broadly organized into key segments such as Confectioneries, Condiments and Preserves, Squashes and Seasonings (its longest standing category), and Ready to Eat and Ready to Cook products, which are among its more recent additions.

The sales mix improved, supported primarily by stronger export performance, although gross margins remained under pressure due to persistent inflationary trends. Liquidity strengthened as the company secured a PKR 200 million short term financing facility from the National Bank of Pakistan, aimed at maintaining adequate working capital. Other income primarily arose from the sale of land in the previous year.

Looking ahead, the company plans to leverage its core strengths across both domestic and export markets to drive topline growth, expand margins, and reinvest in business development. Innovation will remain a core strategic focus, encompassing new product development. While new categories may be explored in the future, management believes there is significant untapped potential within current product segments

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.