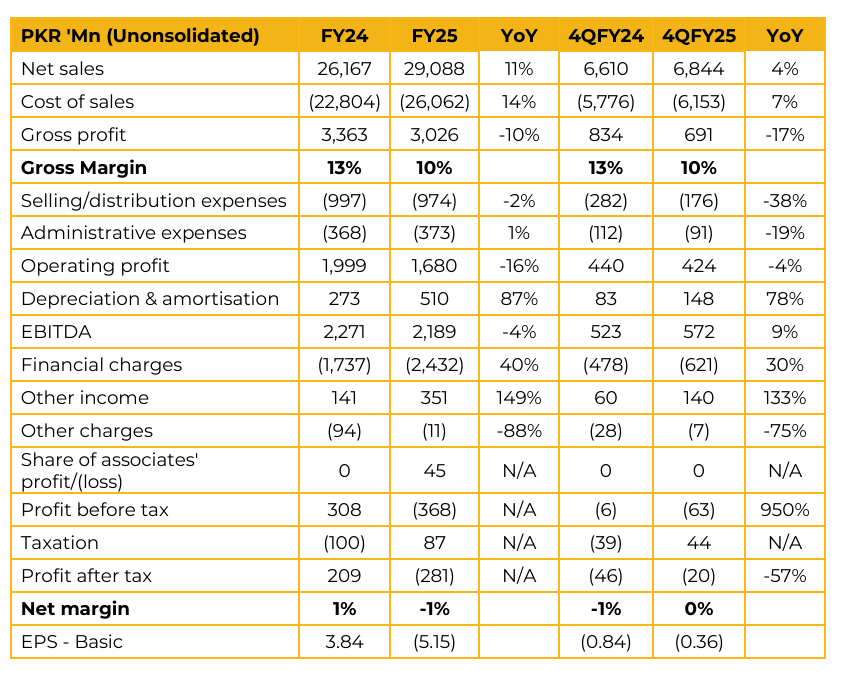

Pakistan Cables Limited (PCAL) reported loss per share of PKR 5.15 for FY25, compared to earnings per share of PKR 3.84 in FY24. Furthermore, in 4QFY25, the company reported loss per share of PKR 0.36, compared to loss per share of PKR 0.84 in the same period last year (SPLY).

A significant potential competitive advantage is the exploration of wind power at the Nooriabad site, which is located in a wind corridor. Management stressed that if pursued, this would be financed via a PPA to avoid further leveraging the balance sheet. Inventories were intentionally raised to buffer against disruptions during the factory shift and are expected to decline in “number of days” terms.

Trade debts rose as the company extended more credit to drive sales in a competitive market. However, the company is now progressing to take advance payments from customers against orders. The 11.15-acre Karachi plot is now classified as “held for sale.” 4.3 acres have been sold, with the remaining 6.8 acres expected to be sold by December 31st. Management noted that the gross margins are expected to improve on the back of reduced overheads and improved demand condition in 2QFY26. The demand remained muted in 1QFY26. To manage copper price volatility, PCAL aligns its copper buying with customer orders. It avoids spot buying and instead purchases over an averaged period (e.g., 3-week or 1-month average) to smooth out price fluctuations.

Going forward, the management expects a volumetric growth to remain in a range of 25%-30% in FY26, with some improvement in the gross margin towards historical average as a result of factory consolidation. A key focus is to drive down finance costs so that the operating profit can translate into net profitability once again. The company is seeing early signs of a recovery, with positive domestic cement sales and increased activity in sectors like autos, textiles, and packaging. They are hopeful this trend will continue.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.