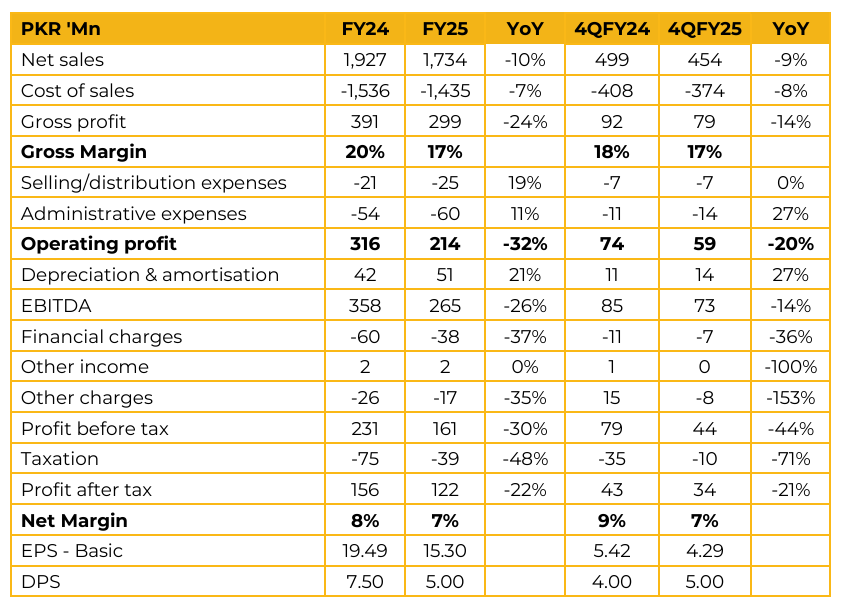

Pakistan Paper Products Limited (PPP) reported earnings per share of PKR 15.30 for FY25, compared to PKR 19.49 in FY24. Furthermore, in 4QFY25, the company reported earnings per share of PKR 4.29, compared to earnings per share of PKR 5.42 in the same period last year (SPLY).

Management indicated that paper prices remain under pressure, which has led to heightened price competition from the unorganized sector, creating challenges in the exercise book segment. Another key factor contributing to the weak pricing environment is the government’s decision to end tender contracts with textbook boards, resulting in no new orders for smaller paper mills.

Consequently, many of these mills have started dumping paper in the open market, further pressuring prices. The company is phasing out production of both sensitized paper and photocopy paper. The plant used for these lines, which is nearly 25 years old, will be sold as scrap.

Meanwhile, management is focused on liquidating the remaining inventory in the sensitized paper segment. In the Pro Label segment, the company has transitioned from UV curing to LED curing in two plants, with plans to convert one or two additional machines by year end.

The LED curing system is approximately 60% less energy-intensive compared to the previous UV technology, significantly improving energy efficiency. Within the topline, Pro Label and Exercise Books contribute 60.8% and 38.07%, respectively. Capacity utilization stands at 122.48% for Pro Labels and 70.81% for Exercise Books, reflecting strong demand in the label segment.

Management highlighted that 92–95% of Pro Label raw materials are imported, and the impact of 15% imposition of RD was not fully passed on to customers the company absorbed part of the cost to maintain competitiveness.

The company cannot freely procure paper from the open market due to the zero-rating status of the exercise book category, under which only government authorized vendors are permitted to supply paper on a zero-rated basis.

Management expects further improvement in both sales and margins within the Pro Label segment. However, sales and margins in the Exercise Book segment are expected to remain under pressure as weak paper prices persist.

There focus will remain on increasing institutional sales in this segment. As per the recent budget, RD on key raw materials has been reduced from 15% to 12%, which provides some relief to the Pro Label segment and helps partially offset input cost pressures.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.