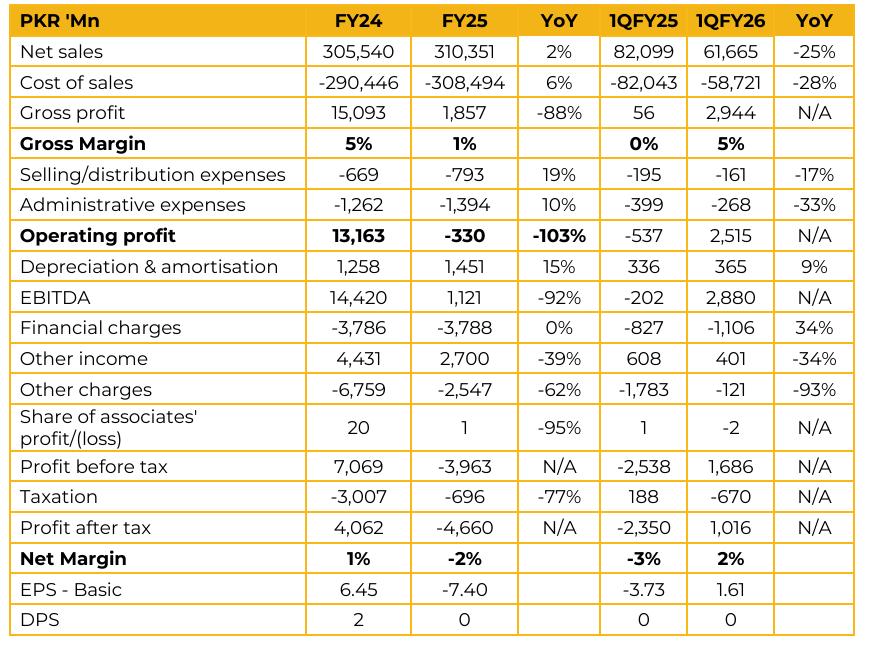

Pakistan Refinery Limited (PRL) reported loss per share of PKR 7.40 for FY25, compared to earnings per share of PKR 6.45 in FY24. Furthermore, in 1QFY26, the company reported earnings per share of PKR 1.61, compared to loss per share of PKR 3.73 in the same period last year (SPLY).

During FY25, the company produced 796k tons of HSD and 300k tons of MS. Crude sourcing relied primarily on the Middle East roughly 70% from ADNOC, 20% from Aramco, and 10% local crude. Capacity utilization remained around 80–85%. Management highlighted that increasing utilization further would require running heavier crude, which would alter yields by increasing furnace oil production.

Given the record MS and HSD output this year, management aims to improve efficiency and sustain higher production. The company has started receiving sales tax on a temporary basis and is in discussions with the government to resolve this permanently.

GRM in 1QFY26 was around US$5/bbl, compared with US$1.5 2.0/bbl during FY25. Management emphasizes that the recent GRM improvement was not due to the resolution of sales tax issue. Freight costs currently stand at US$1.3–1.5/bbl, consistent with Middle East sourcing, while energy cost is about US$1/bbl. Regarding the refinery upgradation, EPC bids have been received; the company is negotiating pricing and other terms with contractors. As this is a US$2bn project, financing remains a challenge and things will materialize over time alongside commercial negotiations.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.