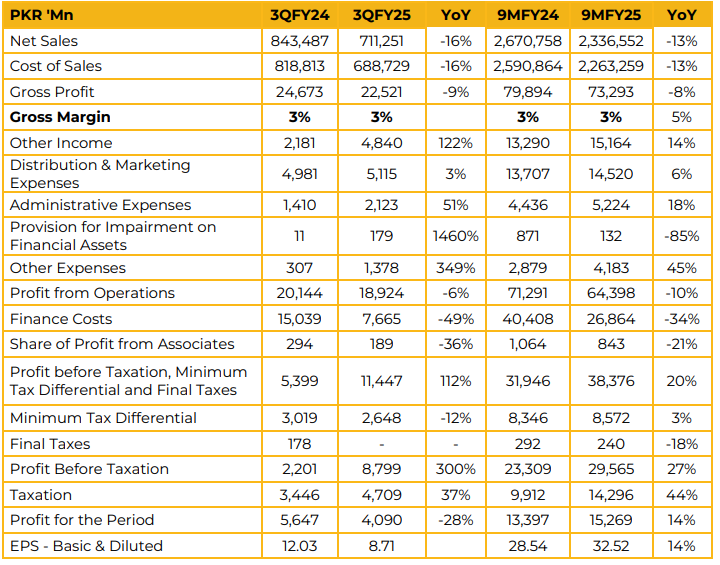

PSO reported a net profit of PKR 15.27 billion (EPS: PKR 32.52) in 9MFY25, up 14% YoY from PKR 13.40 billion (EPS: PKR 28.54) in 9MFY24. Sales revenue was reported at PKR 2.34 trillion in 9MFY25, 13% YoY down from PKR 2.67 trillion during the SPLY. Management reported that during the 9MFY24, a surge in international fuel prices resulted in inventory gains. However, in contrast, the 9MFY25 witnessed a decline in global fuel prices, translating into inventory losses across the industry.

PSO operates over 3600 retail outlets spread across Pakistan, with total storage capacity of 1.24 million tons. Management reported that card sales contribute 12-13% of overall sales. EBITDA excluding all uncontrollable factors (Inventory Losses/Gains) stood at 74 billion for the period ended March 31, 2025 compared to PKR 68 billion in the SPLY.

The break-up of Pakistan’s liquid oil consumption was given as: Mogas 48.3%, HSD 41.9%. Furnace Oil 5%, JP1 4.3% and others 0.5% during 9MFY25. The break-up of PSO’s liquid oil consumption stood at Mogas 44%, HSD 43.7%, Furnace 1.9%, JP1 9.6% and others 0.7% during the same period. Management reported the construction of two storage tanks with a capacity of 25,000 MT each at the Faqirabad depot.

Additionally, four tanks with a combined capacity of 5,300 MT were rehabilitated across KTB, DLP, and LMPA. The company also commissioned 67 new retail outlets during the period. Management reported the OGRA restriction on the new retail outlets as it was tied to storage capacity which the company has enhanced and thus opened new retail outlets and expects to continue the growth of retail outlets.

During the year, PSO secured a 30-year aviation fueling lease at Multan and Faisalabad airports, joined the global JIG standard, and partnered with Pakistan Railways for refueling at eight sites. It launched VIBE convenience stores, signed an EV charging deal with HUBCO Green at 25 sites, automated dispatch at Keamari Terminal, and inked a longterm fuel import agreement with SOCAR. Management expects reasonable margins for EV charging stations at 15- 20%.

The cost of installing EV charging stations was reported at USD 20-25K. The capex for storage terminal was reported at PKR 30-40,000 per metric tons. Management reported that RLNG terms would be based on market situation and forecast period at that time. It will impact the company not next year but the year after that. Management confirmed that power circular debt resolution has been approved.

However, there’s no definitive plan in action. The recurring losses were reported at PKR 34-35 billion. Management reported that the sales tax exemption impacts the company and sales tax receivables stand at where they were. Management reported the government did not bring petroleum products into sales tax ambit. LPS receivables stand at over PKR 200 billion. The company’s priority is to recover the principal amount first. Management reported that the PSO is focused on organic growth and customer loyalty and it is not feasible for the company to offer discounts as many other OMCs have offered discounts to the customers.

The diesel smuggled through Iran was estimated at 1000-4000 tons per day. Going forward, PSO will strengthen its footprint through aviation fueling contracts, JIG membership, and a long-term fuel import agreement with SOCAR. It plans to expand EV charging with HUBCO Green, launch VIBE stores, enhance logistics via automation at Keamari, and support Pakistan Railways at eight refueling sites. Management expects increase in OMC margins due to recent increase in global oil prices. Management aims 3-5% growth in FY26 with organic growth.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.