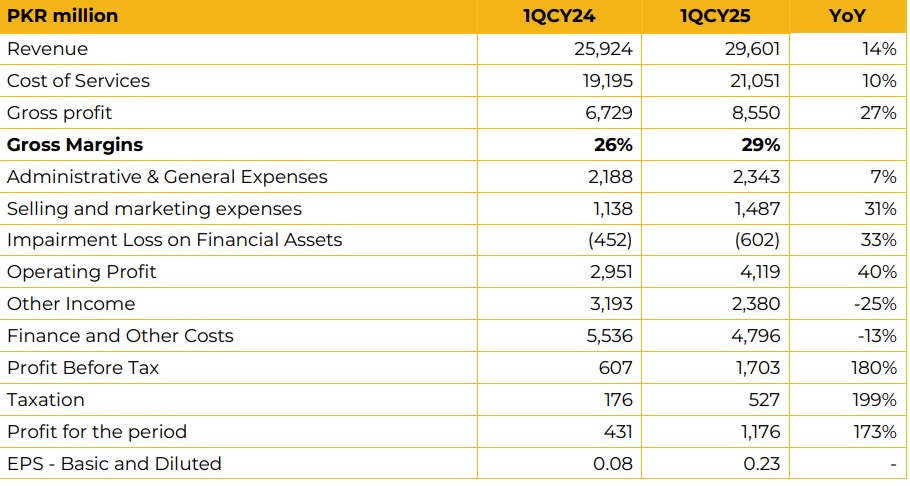

In 1QCY25, PTCL reported a standalone net profit of PKR 1.18 billion (EPS: PKR 0.23), up from PKR 431.25 million (EPS: PKR 0.08) in the SPLY. The increase in profitability was driven by strong performance in Flash Fiber (FTTH) and B2B segments. For CY24, PTCL Group recorded its highest-ever revenue of PKR 220 billion, reflecting a 16% year-on-year growth with all group entities contributing positively. Despite this, the Group posted a net loss of PKR 14.39 billion, compared to a net loss of PKR 16.73 billion in the previous year.

The loss was attributed to higher finance costs, reduced other income, and non-operating items. Segment-wise, PTCL revenue grew by 12% YoY, Ufone by 25% YoY, and UBank by 2% YoY. In CY24, PTCL retail segment recorded 16% revenue growth, crossing PKR 5 billion by August 2024. This was supported by a twofold increase in FTTH revenue to PKR 9.7 billion, raising FTTH’s share in fixed broadband to 46%. Overall fixed broadband (FBB) revenue rose 20%, while Shoq/IPTV revenue grew by 16%.

The total FBB subscriber base reached 1.78 million, backed by record sales of 668K and net additions of 113K. PTCL’s FTTH segment recorded 65% YoY growth, reaching 678K subscribers and capturing a 36% market share. FTTH sales hit an all-time high of 281K, with net additions of 266K, contributing half of the industry-wide additions. FTTH coverage expanded to 1.6 million homes, including 500K new rollouts during the year.

Retail broadband and IPTV revenue increased 20% to PKR 49.28 billion. Wireless data services revenue declined 36% reaching PKR 1.06 billion while voice revenue increased 5% to PKR 8.69 billion. In the Corporate & Wholesale segment, revenue grew by 11% YoY to PKR 38.62 billion.

However, the international segment reported a 2% YoY decline to PKR 10.12 billion. Ufone posted a 25% YoY increase in revenue, with its 4G subscriber base reaching 16 million and total data subscribers growing to 18 million, the highest in the industry. 4G data traffic rose by 34%, and daily active 4G users increased 11%. The postpaid base expanded 21% while high value sales were up 5%. Ufone reported positive operating profitability, which management expects to sustain in CY25. PTCL injected PKR 4.4 billion into Ubank during CY24. Despite achieving 31% YoY deposit growth to PKR 136.6 billion and disbursing PKR 68.7 billion, Ubank reported losses due to challenges in the lending portfolio.

The bank is undergoing portfolio adjustments with a strategic shift toward gold-backed products along with branches optimization. Data Center revenue was up 29% YoY, cloud services up 92%, and ICT solutions up 103%. PTCL Business Solutions revenue grew by 8% YoY, handling 8.37 TBPS of domestic and international traffic. Management noted significant demand potential in this segment, especially in enterprise connectivity. Management clarified that Phase II application is pending before CCP and the PTCL extended availability of funds with IFC for the Telenor acquisition and thus remains unaffected by delays. Regarding 5G, the rollout timeline will depend on government terms and conditions and PTCL is prepared for this auction. Management highlighted the requirement of substantial capital investment for this. Telenor acquisition would reduce operational costs, as per management. Looking ahead, the company aims to become the largest technology player by 2027 and plans to monetize non-core assets of the company.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.