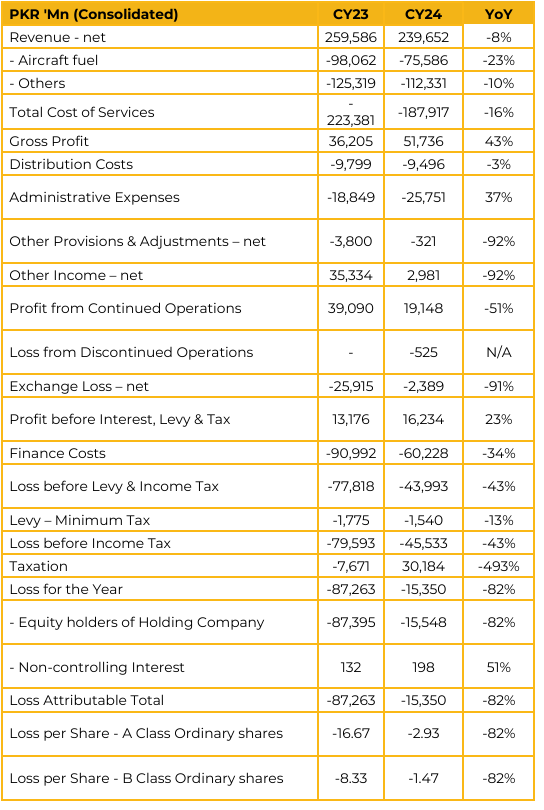

PIA Holding Company Limited (PIAHCLA) reported Loss per share of PKR 2.93 for CY24, compared to PKR 16.67 in CY23. The group’s consolidated revenue was 239 billion, an 8% decrease compared to the previous year. This decline was primarily due to a drop in revenue from its flagship company, PIA.

The decrease in PIA’s revenue was attributed to a continuous decline in global oil prices, which had a direct impact on pricing within the global aviation sector. The deficit was partially mitigated by a strong performance from the hospitality business, which contributed significantly to the improvement in revenue.

The majority of the investment is in the hospitality business. The debt burden transferred from PIA to commercial banks has a finance cost of around 32 billion, while costs for retired employees, including medical and pension expenses, amounted to about 3.3 billion. PIA’s operating profit was 9.3 billion, a significant increase from 3.3 billion last year. This improvement is attributed to ongoing measures, including cost control and a decrease in overall jet fuel prices. It was highlighted that once PIA is relieved of its commercial debt and legacy liabilities, it will be in a position to meet its obligations, potentially achieve a surplus for capital expenditures, and pay off any remaining legacy liabilities.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.