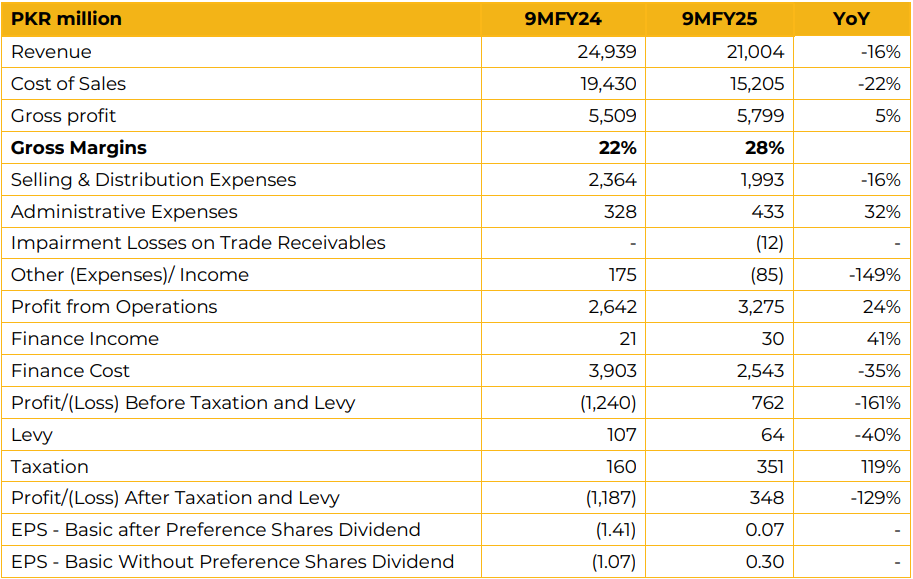

Power Cement Limited reported a net profit of PKR 347.93 million (EPS: PKR 0.07) in 9MFY24, compared to a net loss of PKR 1.19 billion (LPS: PKR 1.41) in SPLY, primarily due to lower finance costs and operational efficiencies. The company recorded its first positive profit before tax in six years.

Revenue declined 16% YoY to PKR 21.00 billion (9MFY23: PKR 24.94 billion), mainly due to a reduction in clinker exports amid depressed international prices. Export proceeds fell by USD 15 million despite USD 24 million inflows from new markets (Africa, USA, UK), as clinker exports dropped 46% YoY to 390,622 tons. Cement exports declined 7.7% YoY to 259,042 tons. The export mix comprised 70% clinker and 30% cement. Clinker production fell 19% YoY to 1.48 million tons, while cement production declined 5% YoY to 1.23 million tons.

Capacity utilization stood at 61% versus 76% in SPLY, affected by weak local demand and lower export prices. Local dispatches, accounting for 61% of total sales, declined 2.96% YoY to 1.02 million tons. Average retention prices ranged between PKR 15,500– 16,500/ton. Clinker export prices were USD 35–37/ton, while cement exports were reported at USD 44–47/ton. Clinker export is based on FOB prices.

Clinker production capacity is 10,700 TPD (3.21 million tons annually), and cement capacity is 11,235 TPD (3.37 million tons annually). Market share increased to 19.0%, second to Lucky Cement (27.5%). The current energy mix comprises HESCO 60%, WHRS 34%, and Solar 6%.

Future mix (P.75) is expected at HESCO 49%, WHRS 34%, Wind 11%, and Solar 5%. In 9MFY24, the 7MW solar plant generated 7,647 MWh, saving 4,166 tons of CO₂, while the WHRS system produced 45,560 MWh, saving 24,828 tons of CO₂. The company targets replacing 20–25% of coal with alternative fuels, which are 25–30% cheaper. The company’s total electricity requirement is 30–35MW during peak demand, with an average consumption of approximately 28MW.

A term sheet was signed with Burj Solar for a 7.5MW wind project under a PPA model, expected to be completed by FY26. Coal accounts for 40% of total costs and is fully imported, primarily from Africa, with current prices at USD 100–105/ton. The new sales tax regime has had no material impact.

Management is in discussions with the FBR to segregate North and South regions. Cement dispatches in the South Zone declined 29% in 1QFY25, but strong recovery in the following quarters limited the 9MFY25 decline to 2%. The company expects the full-year decline to reduce to 1–1.5%. Going forward, management expects higher exports and improved cement production in the coming fiscal year. The company aims to close FY25 at breakeven, with sustained margins supported by operational efficiencies and stable coal and electricity prices.

Management anticipates 7–10% growth in South region demand over the next five years and is targeting lower coal consumption by CY26 to mitigate FXrelated risks. Preference share dividends will be paid after long-term liabilities are cleared, as the loan to foreign lenders is expected to be fully repaid next year.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose