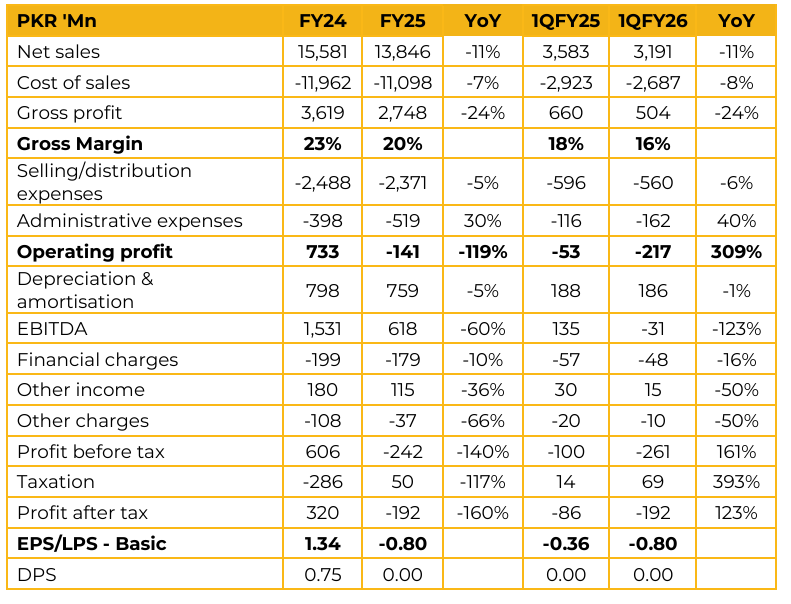

Shabbir Tiles & Ceramics Limited (STCL) reported loss per share of PKR 0.80 for FY25, compared to earnings per share of PKR 1.34 in FY24. Furthermore, in 1QFY26, the company reported loss per share of PKR 0.80, compared to loss per share of PKR 0.36 in the same period last year (SPLY). Sales volume declined to 8.33 mn sqm in FY25, down from 10.39 mn sqm in FY24, as the topline remained under pressure amid a slowdown in the construction sector.

The company faced persistent challenges related to gas availability and low pressure during winter months, along with a sharp increase in freight costs over the past 18 months owing to elevated diesel prices. Its primary raw material is sourced from the northern region, while operations are based in the south creating a cost disadvantage versus Punjab based players, who benefit from local sourcing at lower transportation costs.

Meanwhile, ceramic inks, frits, and glaze continue to be imported inputs. To mitigate rising energy expenses, the company has expanded its solar capacity to further reduce reliance on coal and LPG. Despite the broader industry operating at roughly one third of installed capacity, the company has sustained a higher utilization rate of around 50%. Management highlighted that it remains the only porcelain tile manufacturer in Pakistan. They are focusing on selected niche categories rather than competing on price.

However, competition remains intense, with four large Chinese players operating locally with state of the art machinery. Encouragingly, smuggling from neighboring countries has declined significantly, easing a key threat to the formal sector. Looking ahead, management expects a gradual recovery in demand over the next 8–9 months and indicated that operations have been adjusted accordingly.

The company’s market share of around 10% is expected to remain stable in volume terms but could improve in value terms, supported by its premium pricing and quality-focused strategy.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.