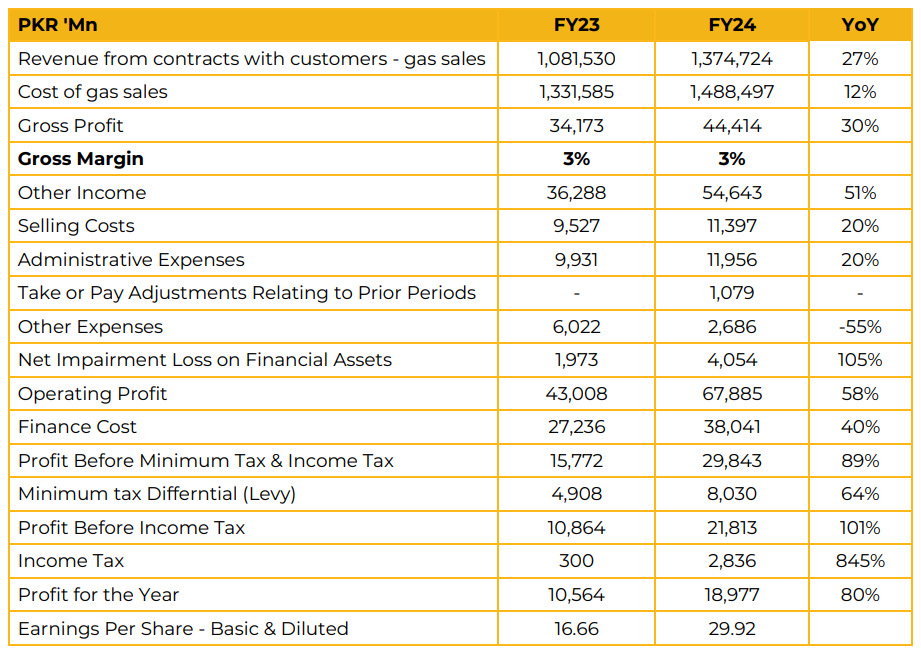

SNGP reported a net profit of PKR 18.98 billion (EPS: PKR 29.92) in FY24, up 80% YoY from PKR 10.56 billion (EPS: PKR 16.66) in FY23. This marks the all-time highest profit for the company. Sales revenue was reported at PKR 1.37 trillion in FY24. During the year, SNGP completed a project in Gilgit and developed a digital map and customer service dashboard. Management completed the connectivity of 95 mmcfd from the Shaheed Fashad Ashfaq Project and integrated BannuWest I and the Wali gas field to SNGP.

Moreover, the company initiated its LPG business during the year. The share of gas supply in FY24 was reported at 41%, with 30% indigenous gas supply and 11% RLNG. The energy mix of Pakistan comprised gas (41%), nuclear (7%), LPG (2%), renewable energy (2%), hydro (12%), coal (15%), and oil (21%). SNGP supplies 69% of the total gas (28% of total energy mix) of the country, compared to the 31% supplied by SSGC. In FY24, the company successfully reduced UFG losses to 4.93%, the lowest in 18 years. The benchmark is based on indigenous distribution and transmission.

Management reported that the old circular debt remains a challenge, but new circular debt is not piling up as it was before due to recent price increases, with only minimal incremental build-up in later periods. To resolve this circular debt issue, the government has hired a consultant, and resolution is expected. During the year, the company made payments beyond 95% to E&P companies. Protected consumers are 4.7 million with volumes of 5.8 bcf, and non-protected consumers are 2.86 million with 7 bcf volume. The company has been incurring an average capex of PKR 30 billion every year.

The management is working on connecting new discoveries and augmentation of systems. There is also continuous meter placement. So, the company expects the current capex trend to continue in the next two years. Management reported challenges after the imposition of a levy on Captive Power Plants.

The company is taking measures to improve visibility, make it affordable for captive power consumers, and improve offtake. Management reported that the levy is being charged through all gas transporters, including third-party, SNGP, and SSGC.

Management denied that any captives are being charged through third parties. The company can pass on the impact if the capital is taken for working capital needs and not allowed for capex. LPS is accumulating due to circular debt. Going forward, SNGP is executing the Kot Palak Gas Project, involving 265 km of pipeline (77 km input and 188 km augmentation) to bring 45 mmcfd gas from a new field. It is also laying a 63 km, 24” pipeline to augment supply and address low pressure in Islamabad and Rawalpindi. Management expects the UFG to improve further.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.