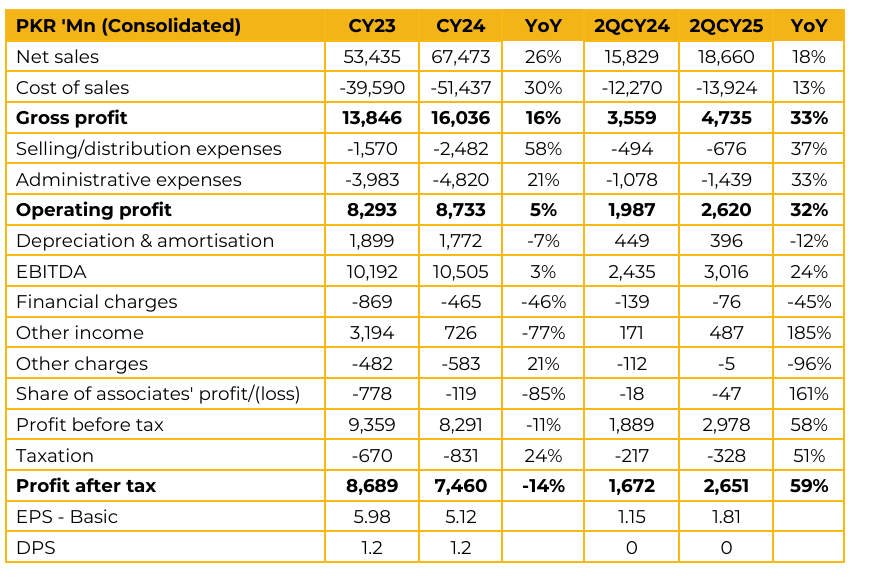

Systems Limited recorded earnings per share of PKR 5.12 in CY24, as compared to earning per share of PKR 5.98 in CY23. In 2QCY25, the company reported earnings per share of PKR 1.81, as compared to earnings per share of PKR 1.15 in 2QCY24. Systems Limited reported $242 million in annual revenue for 2024 and $130.97 million in the first half of the current year, with an EBITDA of $21 million for the same period.

The company has shown consistent expansion with revenue growing at a CAGR of 33% (USD) and 54% (PKR), operating profit at 17% (USD) and 35% (PKR), EBITDA of 13% (USD) and 37% (PKR) and net profit at 18% (USD) and 31% (PKR), with any perceived moderation largely explained by its increasing absolute scale. Its strategy is centered on artificial intelligence, data, and digital transformation, with a strong emphasis on value creation rather than cost reduction.

Significant investments are being made in upskilling talent and reshaping organizational culture to fully capture the potential of AI, which management views as one of the most transformative technological shifts in decades. Systems Limited’s merger and acquisition strategy is focused not just on revenue but crucially on acquiring senior leadership and entrepreneurial talent to manage technological disruption.

This approach seeks to provide a “multiplier effect” for acquired entities by leveraging Systems’ brand and global presence. The acquisition of British American Tobacco (BAT) SAA services is a “game changer,” providing a ready-made high-end shared services offering in areas like marketing, branding, and specialized finance.

This gives Systems an “established reference of MNC”, offering a proven model to expand into other CPG companies and creating a substantial new growth avenue. The company exhibits strong diversification across geographies (57% Middle East Africa, 20% North America) and verticals, with BFSI (30%) and Telco (25%) as key drivers.

Systems focuses on growing existing customers, viewing them as a “gold mine” for new opportunities, and strategically acquiring smaller clients with significant future growth potential. Systems Limited competes directly with major Indian IT service providers in the region, leveraging its strong regional brand, credibility in delivery, and value creation combined with cost effectiveness from its Pakistan and Egypt delivery centers.

The company’s status as a Microsoft Inner Circle partner (top 100 globally) provides significant partnership-driven opportunities. The company’s primary focus is on expanding existing customer relationships, which are seen as a “gold mine” for new AI and technology initiatives due to clients’ increasing need to transform. The company views AI as a tool to augment human capabilities and enhance productivity rather than replace jobs, leading to new roles for individuals with diverse skills like critical thinking. Systems Limited is actively investing in training and upskilling its workforce, acknowledging and managing employee attrition as an ongoing challenge.

Systems Limited benefits from a cost advantage, being generally 30-50% cheaper for talent compared to the Indian market. Pakistan’s improving geopolitical positioning (from negative to neutral/positive) is a “game-changer,” creating a huge opportunity for the industry and potentially attracting a spillover of IT services from Western markets seeking diversification.

Going forward, Systems Limited is positioned to sustain profit growth and strong cash flows, supporting both dividends and reinvestment. With a focus on strategic acquisitions and AI driven transformation, the company is set to capture opportunities from the $4.4 trillion global productivity potential and the AI market’s expansion to $800 billion by 2030, driving long-term value creation.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.