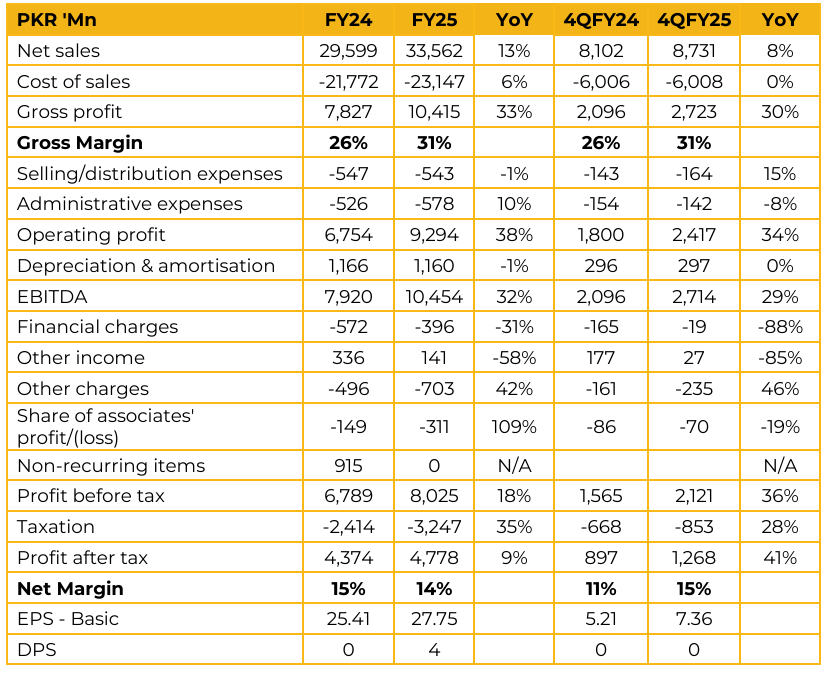

Tariq Glass Industries Limited (TGL) reported earnings per share of PKR 27.75 for FY25, compared to PKR 25.41 in FY24. Furthermore, in 4QFY25, the company reported earnings per share of PKR 7.36, compared to earnings per share of PKR 5.21 in the same period last year (SPLY).

The company has expanded its solar power capacity to 3.5 MW, against a total requirement of 10 MW. Management commented that they assess power prices on a daily basis and dynamically adjust their energy mix to utilize the most cost-efficient source. The company’s topline growth was driven by both higher margins and an increase in product prices. Due to soft demand, one of the company’s furnaces, along with a competitor’s plant, remains non-operational. Management explained that furnaces must operate at full capacity, and when market demand weakens, they build up inventory and may even consider exports at breakeven levels. A waste heat recovery project is in the pipeline.

The company prioritizes internal power generation to ensure production continuity and relies on WAPDA for the remaining power requirement. As unplanned WAPDA shutdowns have had a negative impact on production. Silica sand remains the primary raw material for glass manufacturing.

The company’s weighted average gas cost, sourced from SNGPL and UGDC, stands at approximately PKR 3,300/MMBtu, while the average grid electricity rate is around PKR 38–39 per unit. The company maintains a 50% market share in float glass and 60 70% in tableware.

Float glass contributes about 70% of total revenue, while tableware accounts for 30%. In terms of raw materials, soda ash prices currently stand at PKR 90,000 per ton, while silica sand is priced at around PKR 6,000 per ton. The first furnace is operating at optimal capacity, and management anticipates that improvement in the real estate sector will further boost demand. For Baluchistan Glass, the company plans to expand into the pharmaceutical glass segment, leveraging its strategic proximity to the port to potentially enhance export competitiveness.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.