TPLL reported a net loss of PKR 31.80 million (LPS: PKR 0.14) in CY24, lower than the PKR 42.63 million (LPS: PKR 0.20) loss recorded in CY23. This reduction was primarily driven by PKR 23 million in cost savings achieved through payroll and administrative efficiencies.

In CY24, loss after tax stood at PKR 340 million, reflecting a PKR 138 million rise in expenses. This increase was mainly due to one-off reverse merger costs of PKR 121 million and PKR 75 million in bad debt provisioning. As of CY24, total assets stood at PKR 1.24 billion, and paid-up capital was PKR 2.24 billion.

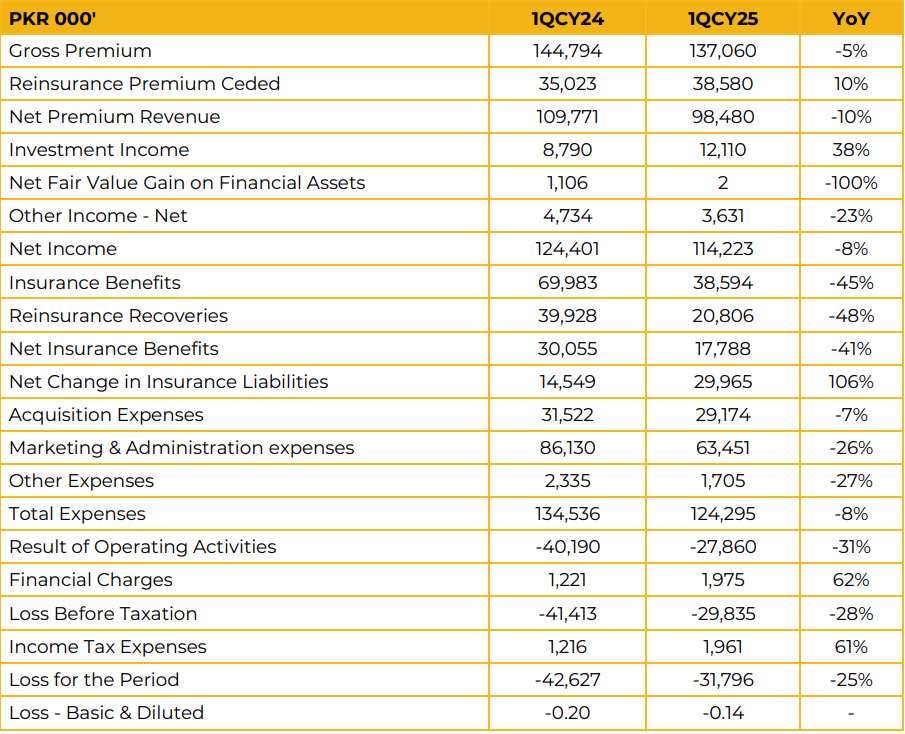

Earned premiums grew by PKR 33 million during CY24, supported by the expansion of the retail business. Investment income declined by 5% YoY to PKR 45.57 million, mainly due to reduced interest income, while other income increased by 22% YoY to PKR 27.65 million. The claims ratio improved to 23%, down from 31%, due to reversed claims. Acquisition expenses rose by 6% YoY to PKR 82.29 million following the launch of unit-linked Takaful products. In 1QCY25, premium revenue stood at PKR 137 million, slightly below the PKR 144 million recorded in the same period last year. The FIG and Agency segments outperformed by PKR 15 million, and Digital Life posted a PKR 1 million increase, while Digital Health and Corporate Life segments underperformed by PKR 21 million and PKR 3 million, respectively.

Net premiums declined by PKR 27 million due to prior-year underperformance and delayed underwriting worth PKR 18 million. Investment income increased by PKR 3 million, attributed to returns from PIBs and Sukuks, although partly offset by a PKR 2 million decline in bank profit. The company has no investments in equities, holding funds only in bank accounts or mutual funds. The claims ratio improved to 26% from 32%, and acquisition expenses decreased by PKR 2 million. TPL Life, as a Life & Health InsurTech firm, provides a payment-enabled app integrated with health tech and usage-based insurance, payable via mobile talk time.

The company has transitioned to a retail-focused model supported by in-house technology for distribution and claims. It distributes insurance through embedded schemes with financial institutions, branch banking via commercial and microfinance banks, and digital platforms such as apps and call centers. TPL Life is pursuing growth through microfinance and telco collaborations.

TPLL is exploring entry into FikrFree and Easypaisa insurance platforms. The company offers various products including Accidental Protection Plan, Orthopedic Cover, Sehat Zindagi, Dental Insurance, Cardiac & Cancer Cover, and Parental Insurance. Since 2022, TPL Life has been shifting from corporate to retail business, which now accounts for over 90% of total operations. Looking ahead, the company maintains a cautiously optimistic outlook, supported by expectations of economic recovery, exchange rate stability, easing inflation, and consistent financial inflows.

With an improving stock market, TPL Life aims to boost its topline and expand its retail footprint through partnerships with Microfinance Institutions. Management is targeting Gen-Z consumers and tier II and III cities with bite-sized products. The company has set a growth target CAGR of 50–65% over the next 2–3 years. It aims to operate through 1,000 branches with 3–4 NFIs in the same period. TPL Life estimates that insurance penetration in Pakistan will reach USD 5 billion by 2030.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose