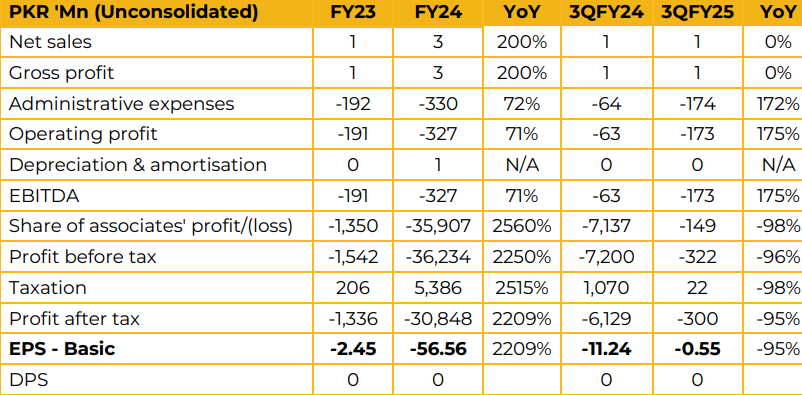

TRG Pakistan limited reported loss per share of PKR 2.45 in FY24 against a loss per share of PKR 56.26 in FY23. Furthermore, in 3QFY25 the company reported loss per share of PKR 0.55 against loss per share of PKR 11.24 in SPLY. For 9MFY25, TRG International reported a profit of PKR 5.259 million, primarily driven by a significant increase in IBEX’s share price during the period. In FY24, TRG recognized a loss of PKR 35.907 million from its associate, TRG International.

This loss was mainly attributable to a revaluation of Affinity’s book value, stemming from debt restructuring, and a sharp 24% decline in IBEX’s market price. The recent ruling by the Sindh High Court (June 2025) regarding Green Tree Holdings’ tender offer is under review. TRG has stated that the ruling contains “several irregularities and infirmities” and is evaluating legal options, including a potential appeal to the Supreme Court. As a holding company, TRG Pakistan’s expenses are largely overhead in nature, with a significant portion related to rising litigation and personnel costs.

TRG International made an incremental investment of several million dollars in Affinity as part of a restructuring effort to protect its interests. Affinity is now controlled by Vista and, as a private company, will no longer disclose financials (such as revenue or profitability) to the public. The new board has pivoted Affinity’s strategy toward generative AI-based products to diversify beyond its traditional offering.

Following the restructuring, a substantial write-down of Affinity’s valuation was recorded on TRG International’s books, resulting in a higher-than-normal loss for FY24. This was a non-cash accounting event and did not involve any share sale. In response to pressure from IBEX management—who believed TRG’s controlling stake (above 25%) was weighing down IBEX’s stock due to litigation overhang—TRG International reduced its stake. The divestment was aimed at unlocking value for all IBEX shareholders.

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.