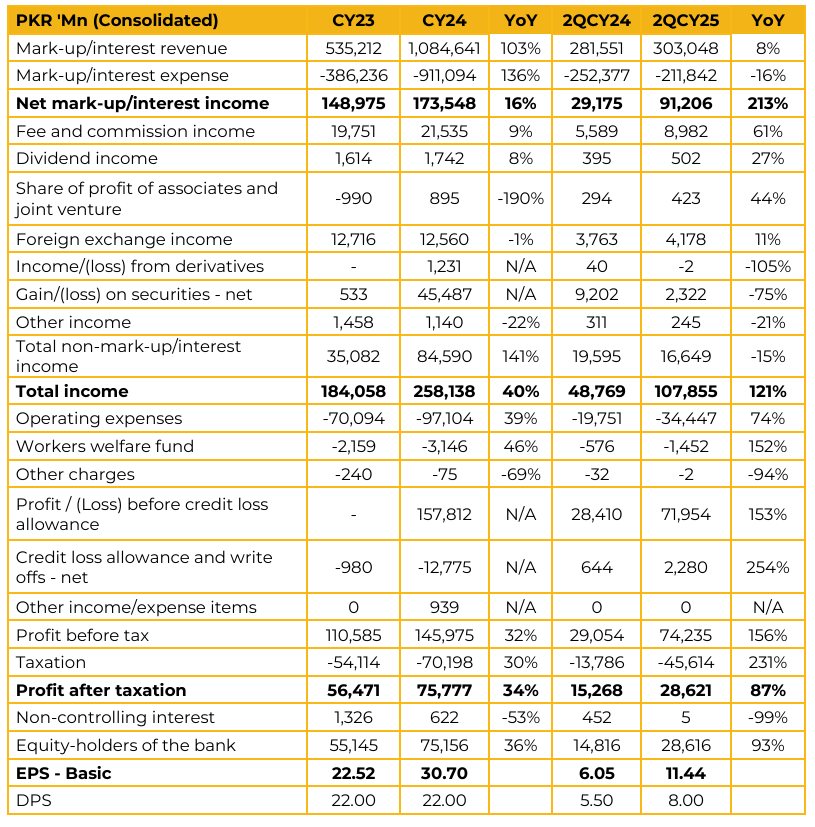

United Bank Limited (UBL) reported consolidated earnings per share of PKR 30.70 for CY24, compared to PKR 22.52 in CY23. Furthermore, in 2QCY25, the company reported EPS of PKR 11.44, compared to PKR 6.05 in the same period last year (SPLY). President highlighted that concerns raised a year ago over whether UBL could simultaneously pursue growth and maintain high dividends have now been addressed through results, demonstrating that both are achievable together.

Management reported that UBL has delivered industry-leading growth over the past two years, where the total deposits have doubled, rising by 98%, while current account deposits increased by 114%, both representing the highest growth in the industry. This has allowed the bank to fully regain its deposit market share of 11.5%, a level not seen for over a decade.

Over the last two years, UBL posted revenue growth of 131% and profit before tax growth of 185%, outperforming all other PSX top-20 firms. The bank has also distributed the highest cumulative dividend on the exchange, PKR 15.15 billion over the last eight quarters, and has raised its dividend payout by 45% this year. The bank remains the leading institution in remittances, though maintaining this position required absorbing quarterly losses of ~PKR 3–4 billion.

Management expects these losses to reduce meaningfully in coming quarters as competitive dynamics normalize. A key driver of profitability has been UBL’s investment in long dated floaters. The bank acquired ~PKR 5 trillion of 10-year floater PIBs at an average spread of 138bps above T-bill rate.

These are currently sitting on unrealized market gains of ~PKR 150 billion, but management confirmed there is no intention to sell, instead holding the assets through their 9-year tenor. In addition, ~20% of the bank’s investment book (~PKR 1.6 trillion) is deployed in fixed-rate PIBs at ~14.9%, effectively hedging the current account portfolio. Management acknowledged the six-month repricing risk inherent in floaters if rates rise, but expressed confidence that long-term gains outweigh short-term volatility.

Management reiterated that UBL has no fixed target for advances growth or ADR ratio, instead adopting an opportunistic approach to lending where acceptable spreads can be earned at manageable risk. The bank maintains a relatively high-risk appetite but is unwilling to extend credit at thin margins or negative spreads.

On branch expansion, management noted that its recent growth in network size primarily came from the acquisition of Silk Bank’s 105 branches. Looking forward, branch openings will remain opportunity-driven, focusing on locations with strong deposit potential.

The bank’s overall trade finance share remains below peers, and management identified this as a priority growth area. UBL’s share in agriculture lending is very small. While its associate concern (Al-Baraka Bank) is active, overall challenges with money dispersion, collection, and past losses have made it difficult. UBL wants to invest but needs to find viable methods Going forward, management expects core deposit growth and long-term floater income to remain the primary earnings engines, supplemented by gradual expansion in consumer and Islamic banking.

Dividend payouts are guided to stay elevated for at least the next two years; balancing shareholder returns with capital retention for growth opportunities.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.